Partnerships with more than 100 partners must file the form and related schedules electronically unless they submit bankruptcy returns or returns with pre-computed interest and penalty.

possession - IRS PO Box 409101 Ogden, UT 84409.

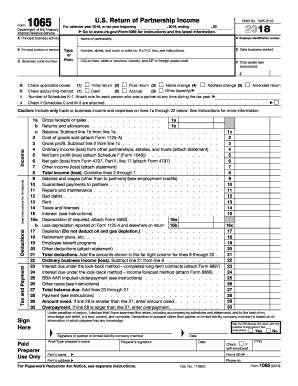

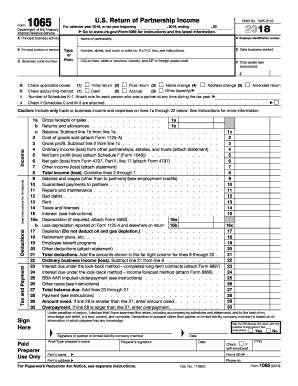

If the partnership is located in a foreign country or U.S. If the partnership is located in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, or Wyoming IRS Center Ogden, UT 84201-0011. Total assets are $10 million or more or you filed Schedule M-3 - IRS Center Ogden, UT 84201-0011. Total assets are less than $10 million and you did not file Schedule M-3, send the form to the IRS Center Kansas City, MO 64999-0011. If the partnership is located in Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, or Wisconsin and:. The 1065 return mailing addresses are the following: The late filing penalty is $210 for each month or part of the month the failure continues multiplied by the number of partners. However, IRS form 1065 due dates can be extended if you file Form 7004. IRS tax form 1065 is filed by the fifteenth day of the third month following the date its tax year ended. Provide information about the balance and capital of the partnership. Schedule M-2 (Analysis of Partners' Capital Accounts). State the net income, guaranteed payments, tax-exempt interest, etc. Schedule M-1 (Reconciliation of Income (Loss) per Books with Income (Loss) per Return. Indicate the assets, liabilities, and capital. Schedule L (Balance Sheets per Books). State the total amount of income (loss), deductions, self-employment, credits, foreign transactions, alternative minimum tax items, etc., and provide the analysis of the net income (loss). Schedule K (Partners' Distributive Share Items). Answer questions with either «yes» or «no», and describe the type of entity. State the income, deductions, tax, and payment. Choose the type of return and the accounting method. Write down the employer identification number, the date the business started, and the total assets. State the name of the partnership and its address. Identify the principal business activity, the principal product or service, and the business code number. Schedule M-3, Net Income (Loss) Reconciliation for Certain Partnerships is required for all partnerships with total assets of $10 million or more to answer questions about their financial statements and reconcile financial statements, net income and return.

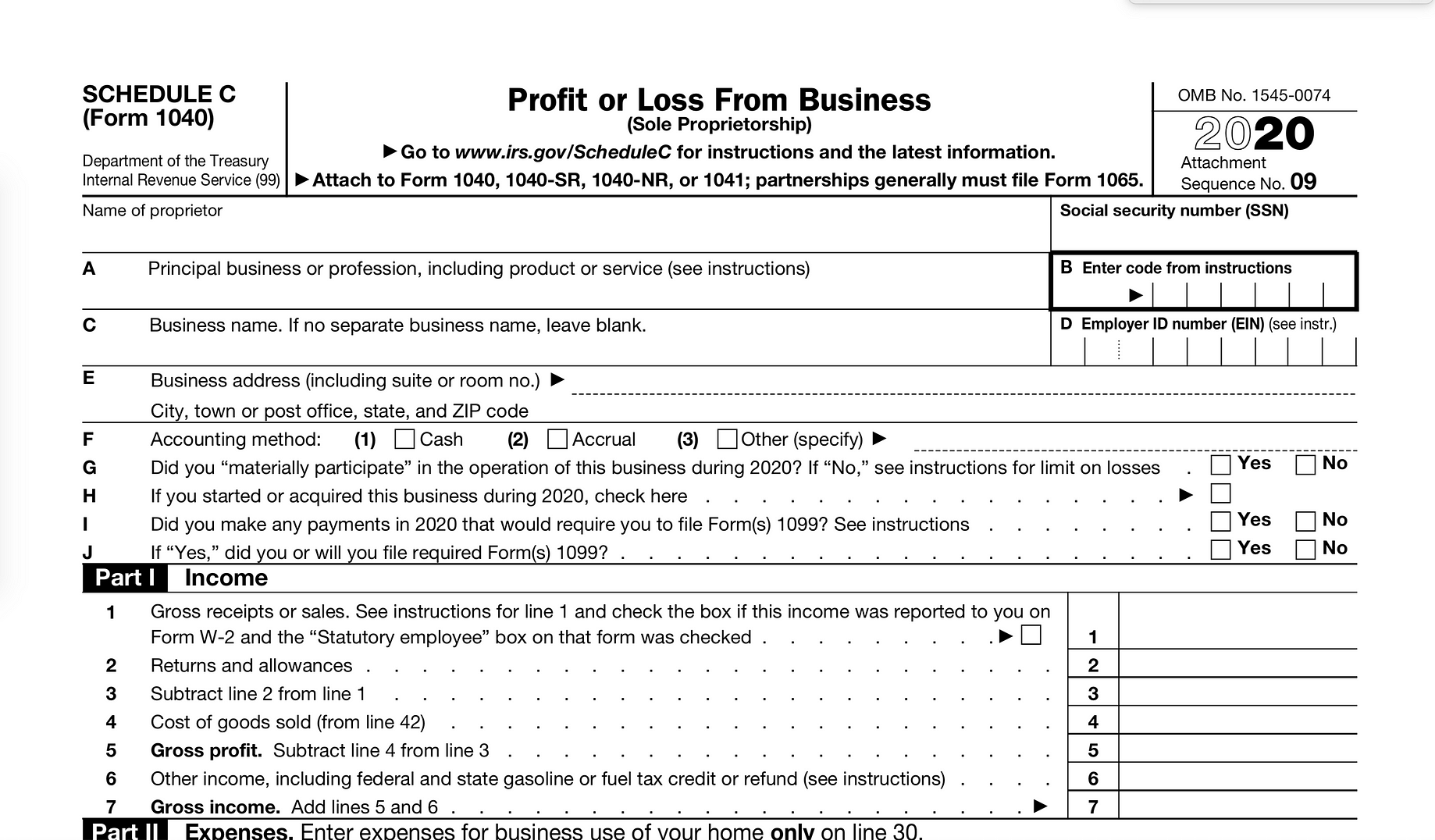

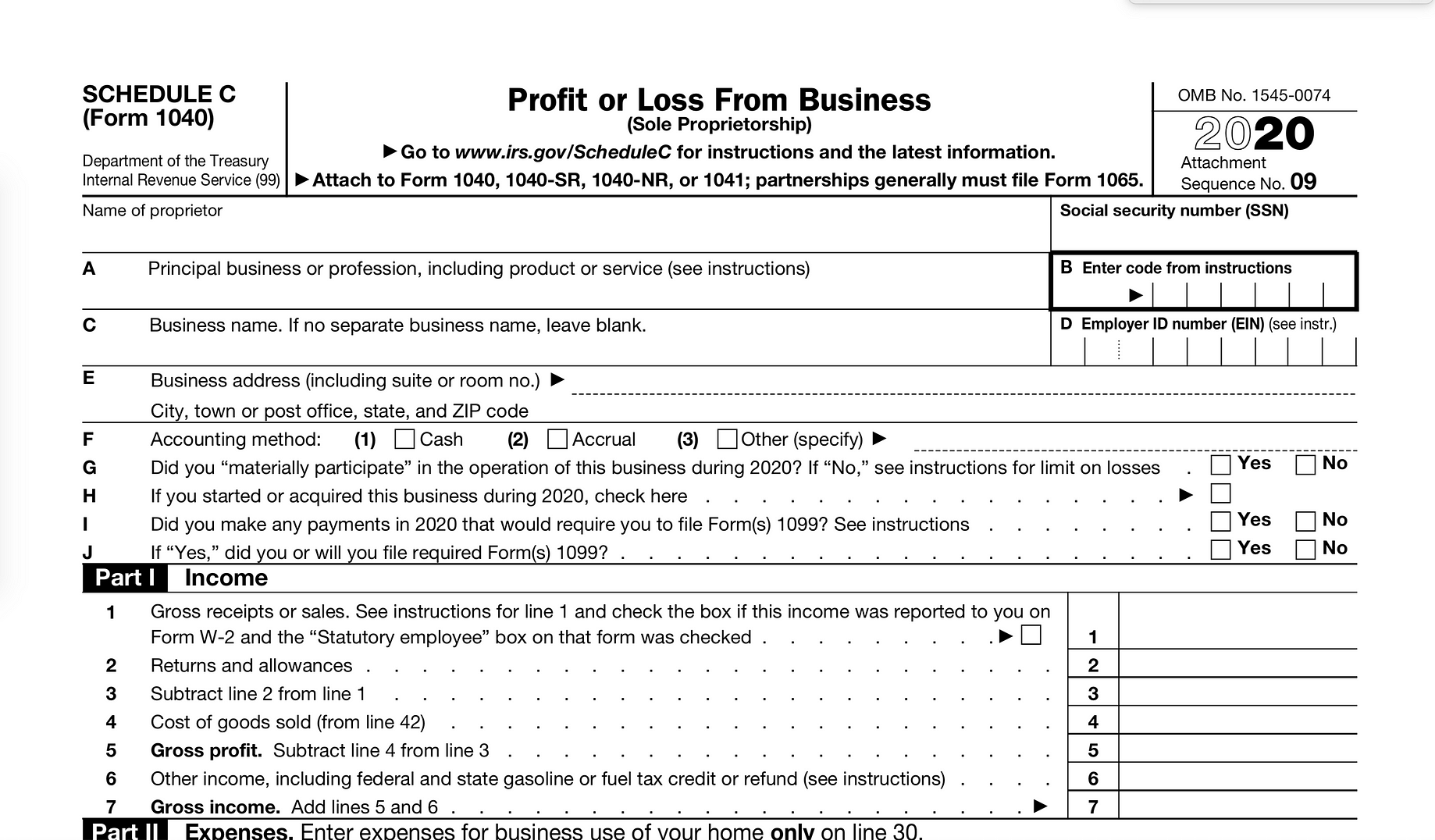

is used to report the distributive share of the partnership's income, deductions, credits, etc. Schedule K-1, Partner's Share of Income, Deductions, Credits, etc.Schedule D, Capital Gains and Losses is required to report capital gain distributions, sales or exchanges of capital assets, and nonbusiness bad debts.Schedule C, Additional Information for Schedule M-3 Filers provides answers to questions for filers of the Schedule M-3.Schedule B-1, Information on Partners Owning 50% or More of the Partnership, is used to submit information on individuals, entities, and estates that own interest of 50% or more in the capital, profit, or loss of the partnership.To comply with the IRS 1065 Form filing requirements, you must file it with certain schedules:

0 kommentar(er)

0 kommentar(er)